Company payroll tax calculator

This payroll tax calculator should be. For example if an employee earns 1500 per week the individuals annual.

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

. Online Payroll Tax Calculator. Social Security tax rate. Free Unbiased Reviews Top Picks.

This FREE business payroll tax calculator will help find out your employees taxes hourly rate of pay and their overtime hourly rate of pay. Both you and your employee will be taxed 62 up to 788640 each with the current wage base. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. GetApp Has Helped More Than 18 Million Businesses Find The Perfect Software. Federal payroll tax rates for 2022 are.

Paycors Tech Saves Time. Our Expertise Helps You Make a Difference. Simplify the complex management of both employee benefits and business insurance with a single all-in-one provider.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Federal tax rates like income tax Social Security. New York Income Tax Calculator 2021.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Enter your employees pay information Most employers use this paycheck calculator to calculate an employees wages. Make Your Payroll Effortless and Focus on What really Matters.

How to File Your Payroll Taxes 1 Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. You can use our calculators to determine how much payroll tax you need to pay. GTM provides this free business payroll tax calculator and overtime calculator to help you find out what your employees taxes standard hourly rate of pay and their overtime hourly rate of.

If you make 149120 a year living in the region of New York USA you will be taxed 36464. Learn About Payroll Tax Systems. How to calculate your employees paycheck Step 1.

Use our free calculator tool below to help get a rough estimate of your employer payroll taxes. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Your average tax rate is 1797 and your marginal tax.

Over 900000 Businesses Utilize Our Fast Easy Payroll. It only takes a few seconds to. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Your employees FICA contributions should be deducted from their wages. Make the hiring process more efficient by tracking all. Explore Our Payroll Products.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. All Services Backed by Tax Guarantee. The rates have gone up over time though the rate has been largely unchanged since 1992.

Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to. 2022 Federal State Payroll Tax Rates for Employers.

Ad The Best HR Payroll Partner For Medium and Small Businesses. Learn About Payroll Tax Systems. Enter your info to.

The calculator can help estimate Federal State Medicare and Social Security tax withholdings. Ad Get the Payroll Tools your competitors are already using - Start Now. Both employers and employees are responsible for payroll taxes.

Ad Reduce Costs By Harmonizing Processes On A Single Payroll System. Calculate your liability for periodic annual and final returns and any unpaid tax interest UTI. Ad Compare This Years 10 Best Payroll Services Systems.

If you want a simple easy-to-use payroll service give us a call at 8779547873 or request a free payroll quote online. 2 Prepare your FICA taxes Medicare and Social Security monthly or. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Ad Compare This Years Top 5 Free Payroll Software. Sign Up Today And Join The Team. Take a Guided Tour.

Just multiply an employees gross pay by each tax ratethats 0062 for Social Security and 00145 for Medicareand subtract that number from the gross pay. Free Unbiased Reviews Top Picks. For Current SurePayroll Customers Estimates made using these payroll.

Sign Up Today And Join The Team. The payroll tax rate reverted to 545 on 1 July 2022.

Payroll Tax What It Is How To Calculate It Bench Accounting

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate Income Tax In Excel

How To Do Payroll In Excel In 7 Steps Free Template

Federal Income Tax Fit Payroll Tax Calculation Youtube

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

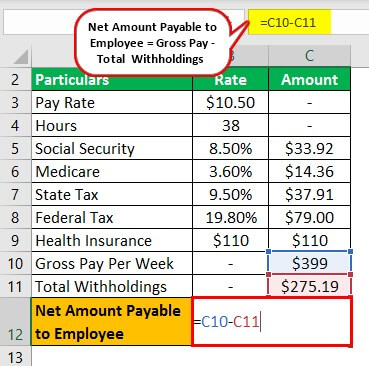

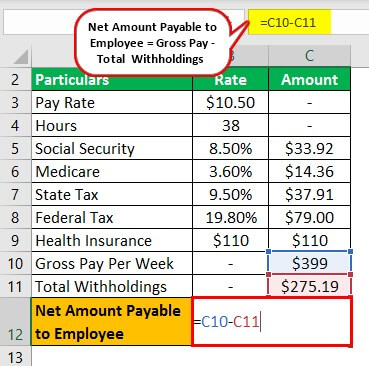

Payroll Formula Step By Step Calculation With Examples

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate Income Tax In Excel

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To Calculate Federal Income Tax

How To Calculate Payroll Taxes Methods Examples More

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Formula Step By Step Calculation With Examples